Financial Data

A leading open-source database for Financial Data & Economic Indicators

The premier source for financial data and economic datasets, serving investment and business professionals. MacroFinance database can be accessed via API, Excel or MacroFinance Web interface. MacroFinance offers free access to a large part of our database to MacroFinance members.

Sign Up to Download Historical Data for over 50,000 Financial, Economic and Social Datasets

[wpdatatable id=2]

Pricing Data covering multiple financial assets and countries

Quantitative indicators of the entire global economy and individual countries

Predictive data from alternative sources or derived data

Financial Database analysis

Our economic database provides an extensive repository of financial data, covering a wide spectrum of economic and market indicators across global financial markets. Designed for institutional investors, analysts, and economists, this database aggregates high-quality, real-time, and historical data for macroeconomic trends, market performance, and alternative financial insights.

Macroeconomic Data for the 35 Largest Economies

The database includes a vast range of macroeconomic data essential for economic analysis and forecasting. It covers GDP, labor markets, inflation, trade, money supply, government fiscal policies, and consumer behavior. Specific indicators include:

- Gross Domestic Product (GDP) – Growth rates, sectoral contributions, and trends.

- Inflation Metrics – Consumer Price Index (CPI), Producer Price Index (PPI), and core inflation measures.

- Labor Market Data – Unemployment rates, jobless claims, labor force participation.

- Leading Economic Indicators – PMI (Purchasing Managers’ Index), ISM (Institute for Supply Management), and ESI (Economic Sentiment Indicator).

- Government & Fiscal Data – Public debt levels, budget deficits, and government expenditures.

Stock Market Data & Index Performance

Our financial database includes in-depth stock market data from the largest global stock exchanges. Users can analyze:

- Major Stock Indices – Performance of key indices such as S&P 500, Dow Jones, NASDAQ, FTSE, DAX, Nikkei, and emerging market indices.

- Individual Stock Data – Price movements, volume trends, and valuation metrics for publicly traded companies.

Bond Market Data for Sovereign & Corporate Debt

The database captures global bond market data, providing insights into fixed-income trends. It includes:

- Sovereign Bond Yields – US Treasuries, German Bunds, UK Gilts, Japanese Government Bonds (JGBs), and emerging market debt.

- Credit Markets – Corporate bond spreads, investment-grade and high-yield debt trends.

Financial Futures Data for 150 Major Markets

A dataset on financial futures allows traders and analysts to track derivative markets for:

- Stock Index Futures – S&P 500, NASDAQ 100, DAX, Nikkei, FTSE, and others.

- Bond Futures – US Treasury futures, Euro-Bund futures, and other sovereign bond derivatives.

- Foreign Exchange (FX) Futures – Major currency pairs and emerging market FX contracts.

- Commodity Futures – Oil, natural gas, gold, agricultural products, and industrial metals.

Commodities Market Data

The financial data repository includes detailed information on commodity prices and market trends, covering:

- Energy Markets – Crude oil (WTI, Brent), natural gas, and coal.

- Precious & Industrial Metals – Gold, silver, platinum, copper, aluminum, and steel.

- Agricultural Commodities – Wheat, corn, soybeans, coffee, and livestock markets.

Alternative Financial Data & Credit Markets

For a deeper market perspective, our financial database incorporates alternative data and credit instruments, such as:

- Credit Default Swaps (CDS) – Market-implied credit risk signals for sovereign and corporate debt.

- Credit Indices – High-yield and investment-grade bond spreads.

- Liquidity & Risk Indicators – Implied volatility, bid-ask spreads, and capital market conditions.

Financial & Macroeconomic Factors Affecting Markets

Our economic database is structured to support in-depth research on how macroeconomic factors influence financial markets. This includes:

- Interest Rate Policies – Central bank decisions, monetary policy outlook, and real interest rate trends.

- Inflation & Deflation Dynamics – CPI/PPI effects on equity and bond markets.

- Business Cycle Indicators – GDP growth cycles, employment trends, and trade flows.

- Market Sentiment Analysis – Volatility indexes, investor positioning, and financial stress indicators.

Financial Data API

Follow the Steps below to Access the MacroFinance Database via the following API:

- Copy the following Code or click to download python file MacroFinance Python API

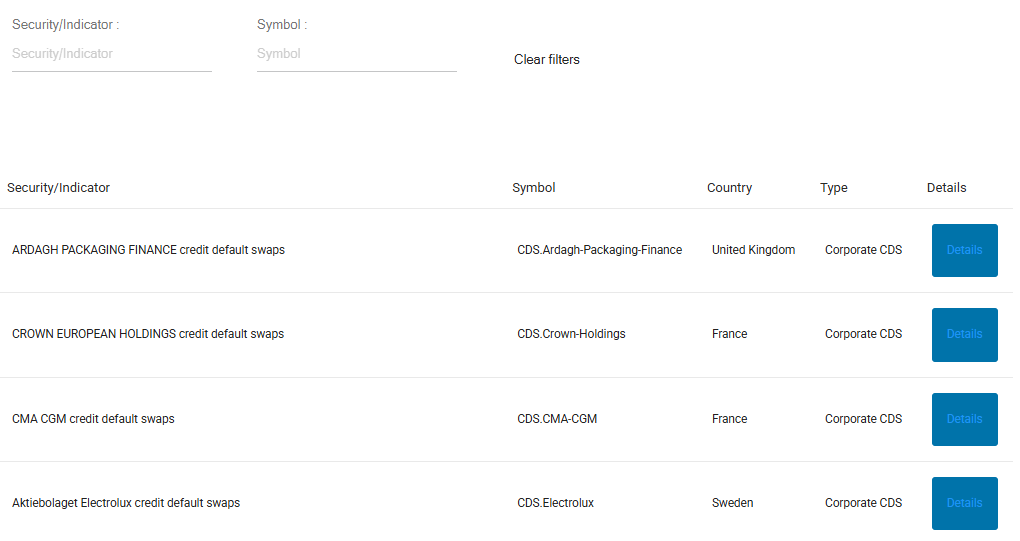

- Search MacroFinance financial securities and macroeconomic indicators database using the search options above

- Insert your Query’s criteria in d=am.load by specifying the variable name, start and end date

import requests

data = {

'api_key':'1fe5d86a-4ca6-11ee-bc70-6cb311235735',

'symbol': 'CDS.Ardagh-Packaging-Finance'

}

r = requests.post('https://api.macrovar.com/api/markets', json=data)

dt=r.json()

Financial Excel Database

Download data from MacroFinance financial data using MS Excel by downloading the Excel file below.